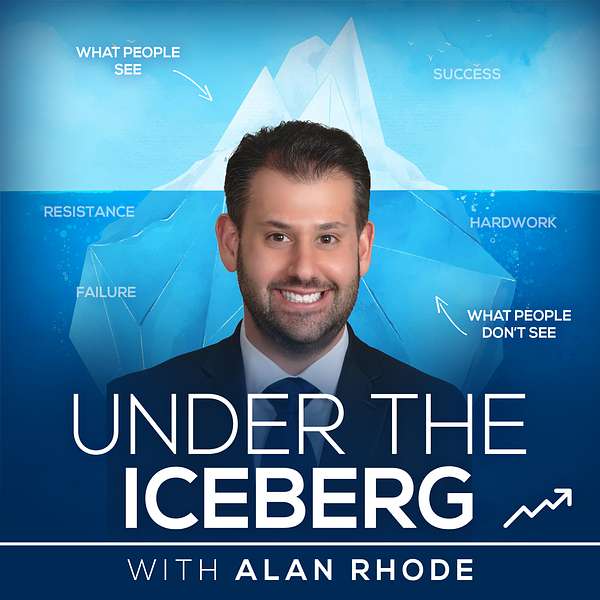

Under the Iceberg

Under the Iceberg is hosted by Alan Rhode, a seasoned Private Wealth Advisor and CEO of Modern Wealth. It is your go-to podcast for diving deep into the world of Financial Planning and Wealth Management for Entrepreneurship and Small Business Ownership.

Join us as we explore these crucial topics in a format that’s both educational and engaging, tailored for Entrepreneurs and Small Business Owners looking to navigate the complexities of modern finance.

Disclaimer: “Under the Iceberg” is for informational purposes only and should not be considered professional financial advice. Consult with a qualified professional before making any financial decisions.

Content is believed to be accurate as of the publication date; however, no warranty of accuracy is given. External links are provided for convenience, with no endorsement implied.

For inquiries or feedback, reach out to alan@modernwealthllc.com.

Under the Iceberg

The Mid-Point of Your Career: Creating Options in Life

Reaching the mid-point of your career isn’t like getting your first high-paying job or the last few years before retirement. Those milestones track closely to age, with the first big job coming in your twenties and retirement happening in your late 50s or early 60s. Please view our full disclosure here.

Reaching the mid-point of your career isn’t like getting your first high-paying job or the last few years before retirement. Those milestones track closely to age, with the first big job coming in your twenties and retirement happening in your late 50s or early 60s.

The mid-point is different. It lasts a lot longer – potentially over a decade – and it’s as much a mindset as a set of circumstances or financial markers.

Essentially, you’ve gotten over the first hurdles, life is good, but you start to realize that you’re going to be working for at least another decade while you get your kids through college and top up your retirement fund.

This is the first time you think about hiring someone to help you sort out your money for many people. You look at your income and bills and realize there’s a lot leftover even after saving into your 401(k). It occurs to you that the cost of messing this up could be on the expensive side.

- Are you saving enough?

- Are you investing correctly?

- Have you thought about risk?

- How about estate planning?

Assuming you’re covering the bases, how about the big questions:

- Is this all there is, or can you create options?

- Can you figure out a way to start your own business or take time off?

- Does your investment plan reflect your values?

While this is by no means an exhaustive answer to those questions, we’ve broken down the big issues for you.

Covering the Bases

The mid-point isn’t different from the other stages in the three most significant money pieces: saving, investing, and taxes. Think about:

Tax-Deferred Investments

Are you hitting the maximum in your 401(k) contributions? You want to lower taxable income when you’re earning, and 401(k) or IRA savings is the most tax-efficient way to do that. While the impulse may be to use an annual bonus or contribute a larger percentage of salary early in the year – or conversely, towards year-end – resist. Spreading out those contributions over the entire year means you can somewhat avoid investing in a falling market.

Education Savings

If you have kids under 10, saving into a 529 plan is the grown-up equivalent of drunk you leaving hungover you a big glass of water on the nightstand. The magic of compounding means that the money you put away now will grow and reduce those college costs. And that means lower loan costs later. The advantage of tax-free growth adds considerably to the benefit. Depending on what state you live in, you may also have state-tax benefits.

After-Tax Investing

A taxable brokerage account for investing additional funds can help you diversify your overall investments and provide access to alternatives or other assets not available in your 401(k). This will potentially subject you to capital gains taxes on your investments, but you will also be able to use tax-loss harvesting techniques to lower your overall tax bill.

Another option is to open an IRA with after-tax funds. When you withdraw it in retirement, you’ll only pay taxes on the growth of the account, not your contributions to the account. You’ll need to file form 8606 every year and keep careful records. You can also use the backdoor Roth strategy and immediately convert the traditional IRA to a Roth IRA, and growth in the account won’t be taxable in retirement. Whether you use the backdoor Roth strategy or not, this can be an option for company stock with a low basis that is likely to grow.

Thinking About Risk

At this stage of your career, you’ve probably created significant assets. And with assets comes liability.

- Have you thought through your insurance?

- Is it time for an umbrella policy?

- Is your life insurance keeping up with your income?

- Have you acquired anything that needs a rider on your homeowner’s insurance?

Estate Planning

If you have minor children, you need an estate plan. You’ll need to identify a guardian for your children if something should happen to you and your spouse, and you’ll most likely need a trust that specifies when and how children should be given an inheritance.

Do You Have Complicated Compensation?

The further along you get in your career, the more opportunities you have to be compensated in potentially lucrative and tax-efficient ways. From deferred compensation to the various ways to purchase or be awarded company stock, you’ll need to understand the restrictions, the benefits, and the tax consequences. You’ll also need to think through your portfolio concentration and the risk of having both your income and investments tied to your employer.

Some questions:

- Should you take advantage of an Employee Stock Purchase Plan?

- Do you have Restricted Stock Units?

- Do you have options that are vesting?

- Can you use the 83(b) election?

Equity compensation can be a great way to build retirement savings and create tax-advantaged sources of income. But it gets complicated quickly, and you need to manage vesting schedules, make selling decisions, think about diversification opportunities, and be sure you can pay the taxes.

Creating Options and Living Your Values

Do you think about taking time out as a family, while your kids are young enough for you all to be together? Could you take a summer off? Enjoying life doesn’t have to wait until retirement. The idea of work-optional has taken root for many people.

If you want your life to be cohesive in reflecting your values, your investments will be a part of that. Putting together an investment plan that achieves both ends – allows you to have freedom and flexibility while conforming to your worldview – is possible. It takes planning and effort, but the two are not mutually exclusive.

The Bottom Line

The mid-point is where you are starting to see your work pay off. You’re still in the building and growing phase, and as you get closer to retirement, you’ll look back on the busyness and chaos of these years with nostalgia. Working with someone who understands your situation and can help you sort out all the pieces of your life can give you peace of mind and get you closer to your goals.